A few nice micro machining service china images I found:

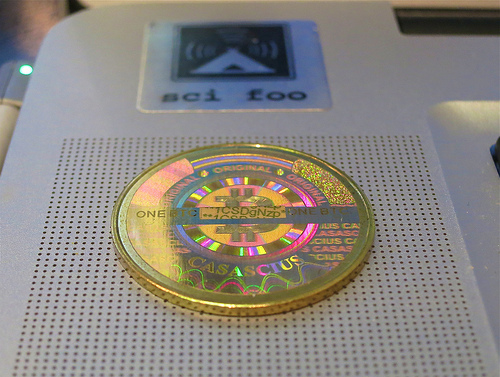

A Bitcoin You Can Flip

Image by jurvetson

My son has become fascinated with bitcoins, and so I had to get him a tangible one for Xmas (thanks Sim1!). The public key is imprinted visibly on the tamper-evident holographic film, and the private key lies underneath.

I too was fascinated by digital cash back in college, and more specifically by the asymmetric mathematical transforms underlying public-key crypto and digital blind signatures.

I remembered a technical paper I wrote, but could not find it. A desktop search revealed an essay that I completely forgot, something that I had recovered from my archives of floppy discs (while I still could).

It is an article I wrote for the school newspaper in 1994. Ironically, Microsoft Word could not open this ancient Microsoft Word file format, but the free text editors could.

What a fun time capsule, below, with some choice naivetés…

I am trying to reconstruct what I was thinking, and wondering if it makes any sense. I think I was arguing that a bulletproof framework for digital cash (and what better testing ground) could be used to secure a digital container for executable code on a rental basis. So the expression of an idea — the specific code, or runtime service — is locked in a secure container. The idea would be to prevent copying instead of punishing after the fact. Micro-currency and micro-code seem like similar exercises in regulating the single use of an issued number.

Now that the Bitcoin experiment is underway, do you know of anyone writing about it as an alternative framework for intellectual property?

IP and Digital Cash

@NORMAL:

Digital Cash and the “Intellectual Property” Oxymoron

By Steve Jurvetson

Many of us will soon be working in the information services or technology industries which are currently tangled in a bramble patch of intellectual property law. As the law struggles to find coherency and an internally-consistent logic for intellectual property (IP) protection, digital encryption technologies may provide a better solution — from the perspective of reducing litigation, exploiting the inherent benefits of an information-based business model, and preserving a free economy of ideas.

Bullet-proof digital cash technology, which is now emerging, can provide a protected “cryptographic container” for intellectual expressions, thereby preserving traditional notions of intellectual property that protect specific instantiations of an idea rather than the idea itself. For example, it seems reasonable that Intuit should be able to protect against the widespread duplication of their Quicken software (the expression of an idea), but they should not be able to patent the underlying idea of single-entry bookkeeping. There are strong economic incentives for digital cash to develop and for those techniques to be adapted for IP protection — to create a protected container or expression of an idea. The rapid march of information technology has strained the evolution of IP law, but rather than patching the law, information technology itself may provide a more coherent solution.

Information Wants To Be Free

Currently, IP law is enigmatic because it is expanding to a domain for which it was not initially intended. In developing the U.S. Constitution, Thomas Jefferson argued that ideas should freely transverse the globe, and that ideas were fundamentally different from material goods. He concluded that “Inventions then cannot, in nature, be a subject of property.” The issues surrounding IP come into sharp focus as we shift to being more of an information-based economy.

The use of e-mail and local TV footage helps disseminate information around the globe and can be a force for democracy — as seen in the TV footage from Chechen, the use of modems in Prague during the Velvet Revolution, and the e-mail and TV from Tianammen Square. Even Gorbachev used a video camera to show what was happening after he was kidnapped. What appears to be an inherent force for democracy runs into problems when it becomes the subject of property.

As higher-level programming languages become more like natural languages, it will become increasingly difficult to distinguish the idea from the code. Language precedes thought, as Jean-Louis Gassée is fond of saying, and our language is the framework for the formulation and expression of our ideas. Restricting software will increasingly be indistinguishable from restricting freedom of speech.

An economy of ideas and human attention depends on the continuous and free exchange of ideas. Because of the associative nature of memory processes, no idea is detached from others. This begs the question, is intellectual property an oxymoron?

Intellectual Property Law is a Patch

John Perry Barlow, former Grateful Dead lyricist and co-founder (with Mitch Kapor) of the Electronic Frontier Foundation, argues that “Intellectual property law cannot be patched, retrofitted or expanded to contain digitized expression… Faith in law will not be an effective strategy for high-tech companies. Law adapts by continuous increments and at a pace second only to geology. Technology advances in lunging jerks. Real-world conditions will continue to change at a blinding pace, and the law will lag further behind, more profoundly confused. This mismatch may prove impossible to overcome.”

From its origins in the Industrial Revolution where the invention of tools took on a new importance, patent and copyright law has protected the physical conveyance of an idea, and not the idea itself. The physical expression is like a container for an idea. But with the emerging information superhighway, the “container” is becoming more ethereal, and it is disappearing altogether. Whether it’s e-mail today, or the future goods of the Information Age, the “expressions” of ideas will be voltage conditions darting around the net, very much like thoughts. The fleeting copy of an image in RAM is not very different that the fleeting image on the retina.

The digitization of all forms of information — from books to songs to images to multimedia — detaches information from the physical plane where IP law has always found definition and precedent. Patents cannot be granted for abstract ideas or algorithms, yet courts have recently upheld the patentability of software as long as it is operating a physical machine or causing a physical result. Copyright law is even more of a patch. The U.S. Copyright Act of 1976 requires that works be fixed in a durable medium, and where an idea and its expression are inseparable, the merger doctrine dictates that the expression cannot be copyrighted. E-mail is not currently copyrightable because it is not a reduction to tangible form. So of course, there is a proposal to amend these copyright provisions. In recent rulings, Lotus won its case that Borland’s Quattro Pro spreadsheet copied elements of Lotus 123’s look and feel, yet Apple lost a similar case versus Microsoft and HP. As Professor Bagley points out in her new text, “It is difficult to reconcile under the total concept and feel test the results in the Apple and Lotus cases.” Given the inconsistencies and economic significance of these issues, it is no surprise that swarms of lawyers are studying to practice in the IP arena.

Back in the early days of Microsoft, Bill Gates wrote an inflammatory “Open Letter to Hobbyists” in which he alleged that “most of you steal your software … and should be kicked out of any club meeting you show up at.” He presented the economic argument that piracy prevents proper profit streams and “prevents good software from being written.” Now we have Windows.

But seriously, if we continue to believe that the value of information is based on scarcity, as it is with physical objects, we will continue to patch laws that are contrary to the nature of information, which in many cases increases in value with distribution. Small, fast moving companies (like Netscape and Id) protect their ideas by getting to the marketplace quicker than their larger competitors who base their protection on fear and litigation.

The patent office is woefully understaffed and unable to judge the nuances of software. Comptons was initially granted a patent that covered virtually all multimedia technology. When they tried to collect royalties, Microsoft pushed the Patent Office to overturn the patent. In 1992, Software Advertising Corp received a patent for “displaying and integrating commercial advertisements with computer software.” That’s like patenting the concept of a radio commercial. In 1993, a DEC engineer received a patent on just two lines of machine code commonly used in object-oriented programming. CompuServe announced this month that they plan to collect royalties on the widely used GIF file format for images.

The Patent Office has issued well over 12,000 software patents, and a programmer can unknowingly be in violation of any them. Microsoft had to pay 0MM to STAC in February 1994 for violating their patent on data compression. The penalties can be costly, but so can a patent search. Many of the software patents don’t have the words “computer,” “software,” “program,” or “algorithm” in their abstracts. “Software patents turn every decision you make while writing a program into a legal risk,” says Richard Stallman, founder of the League for Programming Freedom. “They make writing a large program like crossing a minefield. Each step has a small chance of stepping on a patent and blowing you up.” The very notion of seventeen years of patent protection in the fast moving software industry seems absurd. MS-DOS did not exist seventeen years ago.

IP law faces the additional wrinkle of jurisdictional issues. Where has an Internet crime taken place? In the country or state in which the computer server resides? Many nations do not have the same intellectual property laws as the U.S. Even within the U.S., the law can be tough to enforce; for example, a group of music publishers sued CompuServe for the digital distribution of copyrighted music. A complication is that CompuServe has no knowledge of the activity since it occurs in the flood of bits transferring between its subscribers

The tension seen in making digital copies revolves around the issue of property. But unlike the theft of material goods, copying does not deprive the owner of their possessions. With digital piracy, it is less a clear ethical issue of theft, and more an abstract notion that you are undermining the business model of an artist or software developer. The distinction between ethics and laws often revolves around their enforceability. Before copy machines, it was hard to make a book, and so it was obvious and visible if someone was copying your work. In the digital age, copying is lightning fast and difficult to detect. Given ethical ambiguity, convenience, and anonymity, it is no wonder we see a cultural shift with regard to digital ethics.

Piracy, Plagiarism and Pilfering

We copy music. We are seldom diligent with our footnotes. We wonder where we’ve seen Strat-man’s PIE and the four slices before. We forward e-mail that may contain text from a copyrighted news publication. The SCBA estimates that 51% of satellite dishes have illegal descramblers. John Perry Barlow estimates that 90% of personal hard drives have some pirated software on them.

Or as last month’s Red Herring editorial points out, “this atmosphere of electronic piracy seems to have in turn spawned a freer attitude than ever toward good old-fashioned plagiarism.” Articles from major publications and WSJ columns appear and circulate widely on the Internet. Computer Pictures magazine replicated a complete article on multimedia databases from New Media magazine, and then publicly apologized.

Music and voice samples are an increasingly common art form, from 2 Live Crew to Negativland to local bands like Voice Farm and Consolidated. Peter Gabriel embraces the shift to repositioned content; “Traditionally, the artist has been the final arbiter of his work. He delivered it and it stood on its own. In the interactive world, artists will also be the suppliers of information and collage material, which people can either accept as is, or manipulate to create their own art. It’s part of the shift from skill-based work to decision-making and editing work.”

But many traditionalists resist the change. Museums are hesitant to embrace digital art because it is impossible to distinguish the original from a copy; according to a curator at the New Museum of Contemporary Art, “The art world is scared to death of this stuff.” The Digital Audio Tape debate also illustrated the paranoia; the music industry first insisted that these DAT recorders had to purposely introduce static into the digital copies they made, and then they settled for an embedded code that limited the number of successive copies that could be made from the a master source.

For a healthier reaction, look at the phenomenally successful business models of Mosaic/Netscape and Id Software, the twisted creator of Doom. Just as McAfee built a business on shareware, Netscape and Id encourage widespread free distribution of their product. But once you want support from Netscape, or the higher levels of the Doom game, then you have to pay. For industries with strong demand-side economies of scale, such as Netscape web browsers or Safe-TCL intelligent agents, the creators have exploited the economies of information distribution. Software products are especially susceptible to increasing returns with scale, as are networking products and most of the information technology industries.

Yet, the Software Publishers Association reports that 1993 worldwide losses to piracy of business application software totaled .45 billion. They also estimated that 89% of software units in Korea were counterfeit. And China has 29 factories, some state-owned, that press 75 million pirated CDs per year, largely for export. GATT will impose the U.S. notions of intellectual property on a world that sees the issue very differently.

Clearly there are strong economic incentives to protect intellectual property, and reasonable arguments can be made for software patents and digital copyright, but the complexities of legal enforcement will be outrun and potentially obviated by the relatively rapid developments of another technology, digital cash and cryptography.

Digital Cash and the IP Lock

Digital cash is in some ways an extreme example of digital “property” — since it cannot be copied, it is possessed by one entity at a time, and it is static and non-perishable. If the techniques for protecting against pilferage and piracy work in the domain of cash, then they can be used to “protect” other properties by being embedded in them. If I wanted to copy-protect an “original” work of digital art, digital cash techniques be used as the “container” to protect intellectual property in the old style. A bullet-proof digital cash scheme would inevitably be adapted by those who stand to gain from the current system. Such as Bill Gates.

Several companies are developing technologies for electronic commerce. On January 12, several High-Tech Club members attended the Cybermania conference on electronic commerce with the CEOs of Intuit, CyberCash, Enter TV and The Lightspan Partnership. According to Scott Cook, CEO of Intuit, the motivations for digital cash are anonymity and efficient small-transaction Internet commerce. Anonymity preserves our privacy in the age of increasingly intrusive “database marketing” based on credit card purchase patterns and other personal information. Of course, it also has tax-evasion implications. For Internet commerce, cash is more efficient and easier to use than a credit card for small transactions.

“A lot of people will spend nickels on the Internet,” says Dan Lynch of CyberCash. Banks will soon exchange your current cash for cyber-tokens, or a “bag of bits” which you can spend freely on the Internet. A competitor based in the Netherlands called DigiCash has a Web page with numerous articles on electronic money and fully functional demo of their technology. You can get some free cash from them and spend it at some of their allied vendors.

Digital cash is a compelling technology. Wired magazine calls it the “killer application for electronic networks which will change the global economy.” Handling and fraud costs for the paper money system are growing as digital color copiers and ATMs proliferate. Donald Gleason, President of the Smart Card Enterprise unit of Electronic Payment Services argues that “Cash is a nightmare. It costs money handlers in the U.S. alone approximately billion a year to move the stuff… Bills and coinage will increasingly be replaced by some sort of electronic equivalent.” Even a Citibank VP, Sholom Rosen, agrees that “There are going to be winners and losers, but everybody is going to play.”

The digital cash schemes use a blind digital signature and a central repository to protect against piracy and privacy violations. On the privacy issue, the techniques used have been mathematically proven to be protected against privacy violations. The bank cannot trace how the cash is being used or who is using it. Embedded in these schemes are powerful digital cryptography techniques which have recently been spread in the commercial domain (RSA Data Security is a leader in this field and will be speaking to the High Tech Club on January 19).

To protect against piracy requires some extra work. As soon as I have a digital bill on my Mac hard drive, I will want to make a copy, and I can. (Many companies have busted their picks trying to copy protect files from hackers. It will never work.). The difference is that I can only spend the bill once. The copy is worthless. This is possible because every bill has a unique encrypted identifier. In spending the bill, my computer checks with the centralized repository which verifies that my particular bill is still unspent. Once I spend it, it cannot be spent again. As with many electronic transactions today, the safety of the system depends on the integrity of a centralized computer, or what Dan Lynch calls “the big database in the sky.”

One of the most important limitations of the digital cash techniques is that they are tethered to a transaction between at least three parties — a buyer, seller and central repository. So, to use such a scheme to protect intellectual property, would require networked computers and “live” files that have to dial up and check in with the repository to be operational. There are many compelling applications for this, including voter registration, voting tabulation, and the registration of digital artwork originals.

When I asked Dan Lynch about the use of his technology for intellectual property protection, he agreed that the bits that now represent a bill could be used for any number of things, from medical records to photographs. A digital photograph could hide a digital signature in its low-order bits, and it would be imperceptible to the user. But those bits could be used with a registry of proper image owners, and could be used to prove misappropriation or sampling of the image by others.

Technology author Steven Levy has been researching cryptography for Wired magazine, and he responded to my e-mail questions with the reply “You are on the right track in thinking that crypto can preserve IP. I know of several attempts to forward plans to do so.” Digital cash may provide a “crypto-container” to preserve traditional notions of intellectual property.

The transaction tether limits the short-term applicability of these schemes for software copy protection. They won’t work on an isolated computer. This certainly would slow its adoption for mobile computers since the wireless networking infrastructure is so nascent. But with Windows ’95 bundling network connectivity, soon most computers will be network-ready — at least for the Microsoft network. And now that Bill Gates is acquiring Intuit, instead of dollar bills, we will have Bill dollars.

The transaction tether is also a logistical headache with current slow networks, which may hinder its adoption for mass-market applications. For example, if someone forwards a copyrighted e-mail, the recipient may have to have their computer do the repository check before they could see the text of the e-mail. E-mail is slow enough today, but in the near future, these techniques of verifying IP permissions and paying appropriate royalties in digital cash could be background processes on a preemptive multitasking computer (Windows ’95 or Mac OS System 8). The digital cash schemes are consistent with other trends in software distribution and development — specifically software rental and object-oriented “applets” with nested royalty payments. They are also consistent with the document-centric vision of Open Doc and OLE.

The user of the future would start working on their stationary. When it’s clear they are doing some text entry, the word processor would be downloaded and rented for its current usage. Digital pennies would trickle back to the people who wrote or inspired the various portions of the core program. As you use other software applets, such as a spell-checker, it would be downloaded as needed. By renting applets, or potentially finer-grained software objects, the licensing royalties would be automatically tabulated and exchanged, and software piracy would require heroic efforts. Intellectual property would become precisely that — property in a market economy, under lock by its “creator,” and Bill Gates’ 1975 lament over software piracy may now be addressed 20 years later.

——–end of paper———–

On further reflection, I must have been thinking of executable code (where the runtime requires a cloud connect to authenticate) and not passive media. Verification has been a pain, but perhaps it’s seamless in a web-services future. Cloud apps and digital cash depend on it, so why not the code itself.

I don’t see it as particularly useful for still images (but it could verify the official owner of any unique bundle of pixels, in the sense that you can "own" a sufficiently large number, but not the essence of a work of art or derivative works). Frankly, I’m not sure about non-interactive content in general, like pure video playback. "Fixing" software IP alone would be a big enough accomplishment.